Daily Market Analysis and Forex News

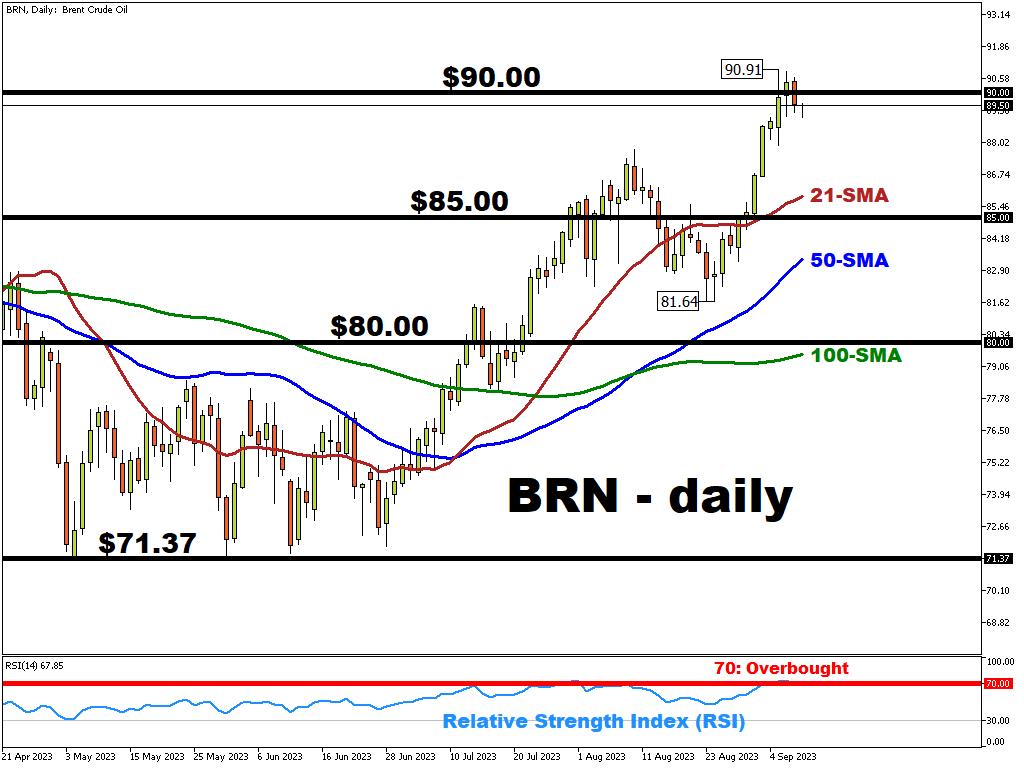

BRN at $90/bbl

Oil prices have experienced a strong boost following the decision by Saudi Arabia and Russia to extend oil production cuts of 1 million bbl/day and 300,000 bbl/day respectively until the end of 2023. The decision came on top of the previously introduced OPEC+ cuts in April.

Saudi Arabia has also hinted about the possibility of deeper production cuts in the future.

Squeezed output, combined with a higher-than-expected US Crude Inventories’ reading on Wednesday, has propelled Brent Crude above the psychologically important $90 level for the first time since November 2022.

Analysts predict that oil prices could move above $100 if Russia and Saudi Arabia extend their production cuts into next year.

Despite strong support coming from the world’s largest oil producers, uncertainty surrounding the future of the US economy in light of a potential rate hike in the coming months may put significant pressure on oil bulls.

Investors are also worried about the potential decline in demand from China after mixed macroeconomic data was published earlier this week which showed that August exports declined 8.8% y/y while imports fell 7.3%.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.