Daily Market Analysis and Forex News

Gold awaits NFP test around $2050

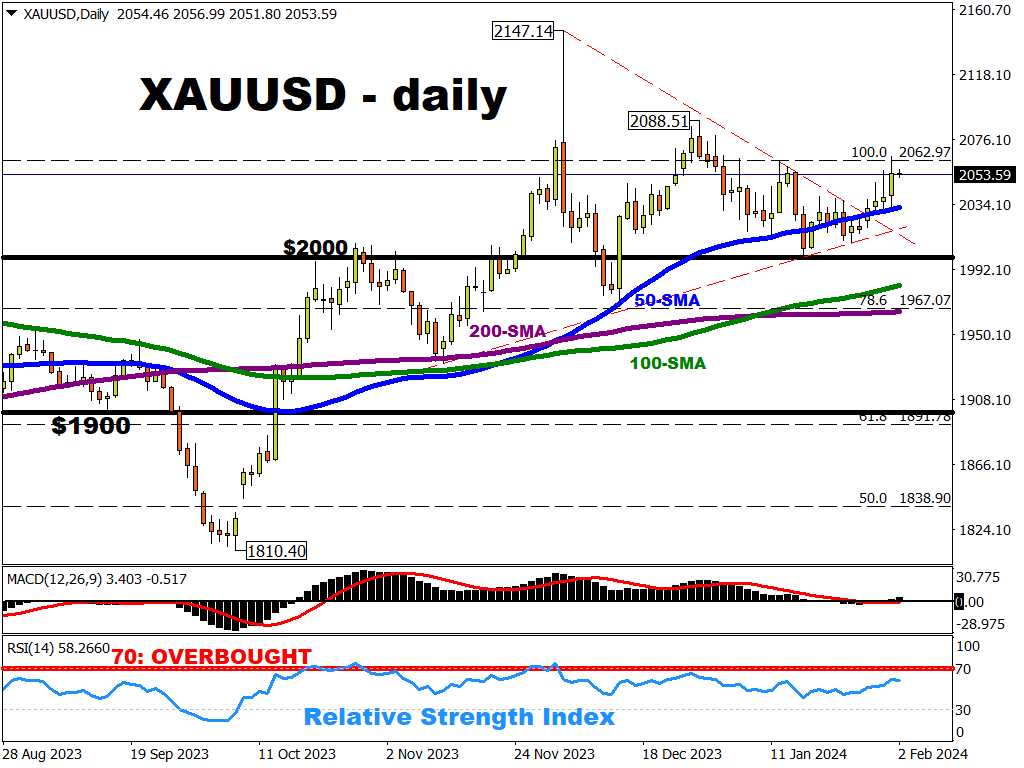

Spot gold has launched back into the mid-$2000 range after recently finding support around its 50-day simple moving average (SMA).

Here are some factors that may have helped push gold prices higher this week:

- higher-than-expected US jobless claims helped bullion bulls move past Fed Chair Jerome Powell’s attempt to dismiss the likelihood of a March rate cut.

- rising fears around US regional banks, which prompted US Treasury yields lower.

- markets are perhaps bracing for the US response to the attacks on US troops in Jordan.

The May 2023 peak of $2062.97 has now thwarted gold's attempts to break higher on 3 different occasions so far this year, with the latest instance occurring yesterday (Thursday, February 1st).

Bullion bulls (those who believe that prices will move higher) will now have to bide their time, as markets keep watch over the incoming US jobs report.

If the incoming NFP prints to a weakening US jobs market that further paves the way for Fed rate cuts, that could push spot gold another leg higher past $2063.

However, if the US labour report continues to demonstrate its resilience, that could prompt the precious metal to ease back lower to test support at its 50-day SMA once more.

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.