Daily Market Analysis and Forex News

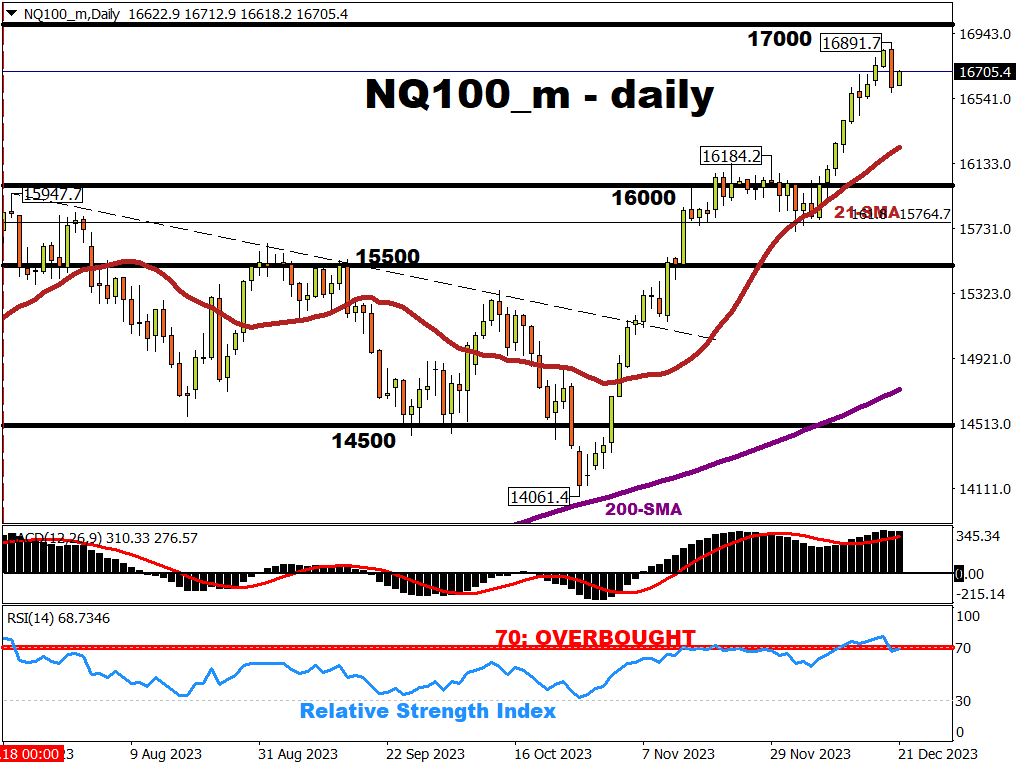

NQ100_m pulls back from record high

It’s been a great year for US stock markets!

In case you missed it, the NQ100_m has been hitting fresh all-time highs this week!

This past Monday (Dec 18th), this US stock index surpassed its prior record intraday high of 16,770.6 that was printed on 22 November 2021.

This rally then peaked, for now, at 16,891.7 yesterday (Wednesday, Dec 20th), before experiencing a technical pullback.

This technical pullback had been due for some time.

After all, the NQ100_m’s 14-day relative strength index (RSI) had broken above the 70 level which marks “overbought” conditions since last week.

With the 14-day RSI now back below the 70 threshold, this technical pullback may well clear the froth, potentially setting a stronger base for the NQ100_m to pursue further gains.

And indeed, at the time of writing, the NQ100_m is looking to restore itself back onto higher ground.

NQ100_m bulls aiming for 17k

Note that the psychologically-important 17,000 level is about 1.7% away from current prices.

Measured from the existing intraday record high of 16,891.7, that 17k round number is a mere 0.64% away from the psychologically-important 17,000 mark.

In other words …

As long as the traditional “Santa Rally” holds true, NQ100_m should have little trouble claiming the 17,000 handle in the near future.

NOTE: The “Santa Rally” points to seasonal gains for US stock markets around the Christmas period.

Using the textbook definition, it typically starts in the final 5 trading days of the year, and ends by the 2nd trading day of the new year.

To be clear, US stock indices, such as the SPX500_m, the WSt30_m, and the NQ100_m, have been surging since the Fed policy decision on November 1st.

Why has NQ100_m been soaring?

More recently, stock markets have rejoiced in the Fed’s policy pivot as conveyed at the December 13th decision.

The US central bank forecasted multiple interest rate cuts in 2024.

Stocks usually revel in the prospects of interest rates move downwards.

Lower interest rates make it cheaper for companies to borrow money to fund its business activities and growth, potentially creating more value for shareholders.

Hence, stock bulls (those hoping that prices will go higher) are getting ahead of such anticipated gains and buying into US equities.

Also note that 2024 is set to be a US Presidential Election year.

Since it was launched on January 31st, 1985, the Nasdaq 100 index has posted an annual gain for every US Presidential Election year, except in the year 2000 (the year of the dot com bubble) and 2008 (Global Financial Crisis).

If that historical behaviour holds up in 2024, that should imply a positive year for US stock indices ahead.

Such tailwinds are set to add to the artificial intelligence mania that has been primarily responsible for the Nasdaq 100’s 51% climb year-to-date (so far in 2023).

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.