Daily Market Analysis and Forex News

UK Stock FTSE 100 near critical levels

These hasn’t been much top tier macro data out of the UK recently, but this hots up next week with the all-important jobs and wage growth figures, ahead of UK CPI data the following week which will play a huge part in the Bank of England rate decision a day later.

However, we have heard from various BoE officials on the wires with comments yesterday impacting rate expectations. Governor Bailey and MPC member Cunliffe both sounded somewhat dovish even without fellow colleague Dhingra who continued to defend her dissension against recent rate hikes.

The former said many indicators signal a fall in inflation which will be quite marked.

Bailey also said the MPC is no longer in a phase where it is clear that rates need to rise, and rates were much nearer to their peak. He reiterated that the bank is now data-driven as policy is restrictive.

Marekts are now for the first time questioning if the bank will hike rates at all in a few weeks’ time. Interest rate pricing for that meeting has now fallen below 20bps so there is more than a material chance (20%) of policymakers standing pat.

All eyes will be on the price data to come in the next few weeks.

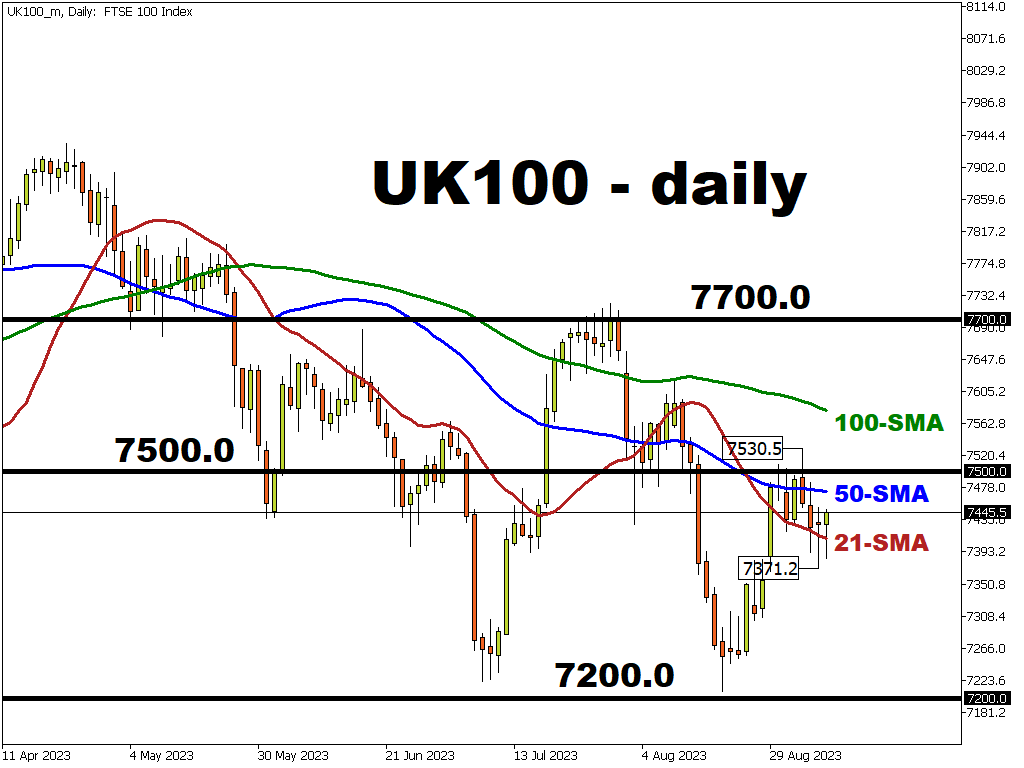

FTSE rolling over

How this effects the UK’s main equity index comes in different ways. The index is made up of interest rate sensitive stocks like banks, insurers and homebuilders. That means if the BoE are gearing up for a “higher rates for longer” rates theme, then this will impact those heavyweight stocks.

Indeed, Chief Economist Pill said recently that he preferred a “Table Mountain” profile for UK rates, where they remained moderately high for some time rather than escalating rapidly and then dropping quickly.

On the flip side, a falling pound is good for many of the index constituents as over 70% of the companies listed earn their revenues overseas.

These include the oil majors, energy and mining companies.

That said, the surfeit of value stocks means there is a severe lack of tech companies which has resulted in the FTSE 100 missing out on the mega rally in AI-related stocks this year which has fueled the broader indices across the pond. The UK index is in the red so far in 2023 while the Nasdaq is close to 40% higher.

Technically, prices are nearing the midpoint of the October rally from last year at 7377. The index has dropped below here briefly on three occasions this year in March, July, and August. Momentum indicators have turned lower so sellers may target the next Fib level at 7219 and those three bottoms around 7200.

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.