Daily Market Analysis and Forex News

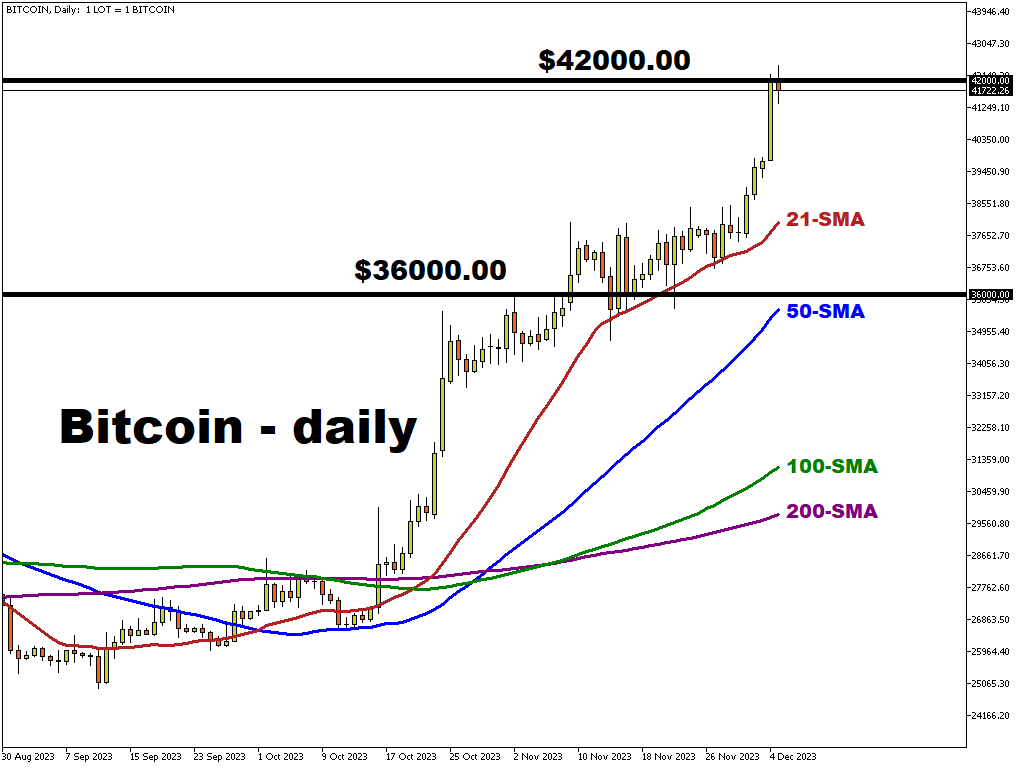

BTC pierces $42,000

Bitcoin is currently into its eight consecutive week of gains.

In that time the world’s most popular cryptocurrency has incredibly gained over 50% in value which means the cryptocurrency is up around 150% on the year.

Yesterday saw fresh near 20-month highs which briefly caused the coin to have made back over half its losses from the all-time high and November low last year.

Frenzied investors have been bidding up riskier assets amid rampant speculation that interest rates will be cut in the first half of next year.

This narrative was boosted by the appearance of Fed Chair Powell on Friday, whose pushback against policy easing pricing was seen as modest with over 100bps worth of Fed cuts predicted by money markets next year.

Too much loosening, too quickly?

The recent rush into numerous asset classes, like stocks, bonds and gold has come ahead of strong seasonals, especially into year-end and the traditional “Santa Rally”.

The huge recent move down in Treasury yields has substantially eased financial conditions, which include a broad mix of indicators like equity valuations and bond yields.

The fall in the dollar has also caused a loosening in these conditions which incentivises risk taking. Some economists quantify this easing as equivalent to four quarter-point rate cuts, in the matter of just one month.

Markets do tend to overshoot and fixate on themes, like the “higher for longer” narrative that was hugely popular earlier in the year.

Top tier US data this week will have a say in all of this, as this includes ISM Services and employment figures which conclude the week with the monthly US non-farm payrolls report.

Crypto likes liquidity…

As we wrote last week, risky assets and cryptocurrencies both prosper with cheap, fiat liquidity.

Lower yields on ultra-safe US Treasury debt have made other assets relatively more attractive.

Still relatively steady growth and falling inflation has given rise to a “Goldilocks” environment which has also helped cryptos.

Certainly, the end of two of the most high-profile criminal cases around digital assets has brought to a close uncertainty around the market.

Binance, the world's largest crypto exchange, was forced to pay huge $4.3 billion penalties, but wasn’t shut down.

Of course, the successful prosecution of Sam Bankman-Fried has highlighted major issues but closed that dark chapter.

Going forward, ETF speculation continues and will drive price action.

This will potentially open up the digital asset world to millions more investors, especially hesitant institutions.

But for now, bitcoin’s surge yesterday pushed it into overbought territory and resistance at the 50% mark of the decline from the all-time high to November 2022 low.

This means a correction is due amid the recent rally.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.