Daily Market Analysis and Forex News

Brent finds scant relief from China’s softer tariff tone

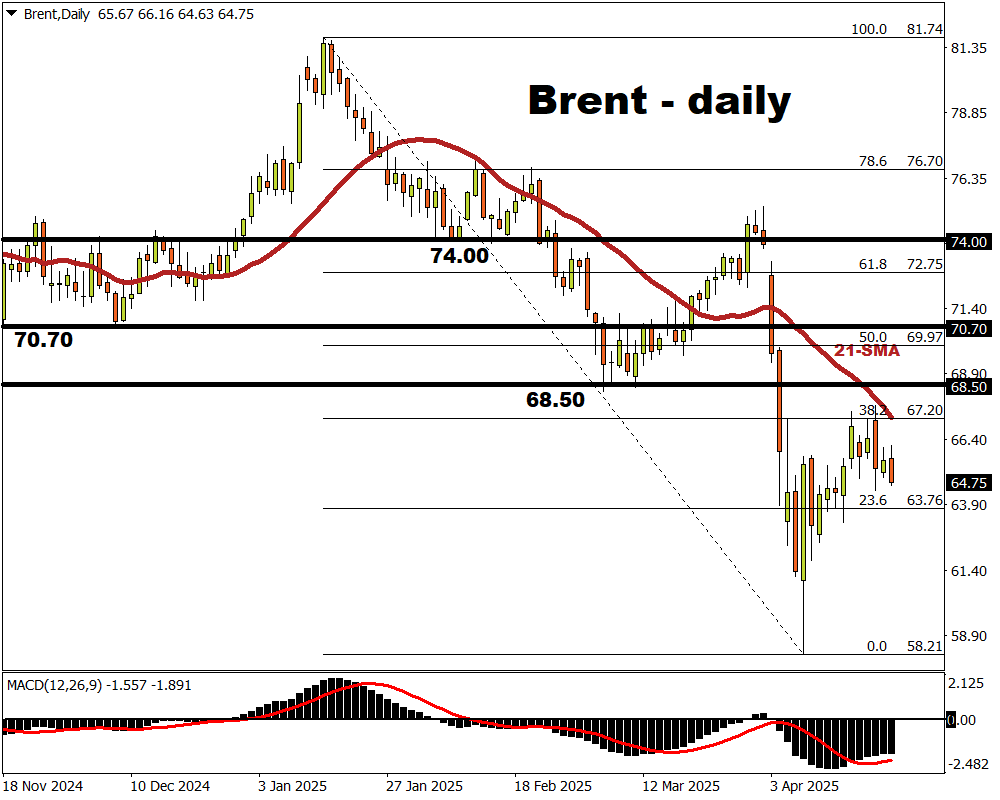

- Brent set for weekly drop, despite China's reportedly softer tariff tone

- Oil's rebound from 4-year low thwarted by 21-day SMA, key Fib level

- Brent's upside limited by persistent trade war fears

- Another bumper-sized OPEC+ output hike could send Brent below $60 again

Oil prices are falling Friday, despite reports of China softening its tone surrounding retaliatory tariffs.

Yet Brent's rebound from its 4-year low appears to be faltering, thwarted by its 21-day simple moving average (SMA), and the 38.2% Fibonacci retracement level from its year-to-date high and low.

At the time of writing, Brent is set for a weekly loss amid persistent trade war risks and the prospects of a price war among OPEC+ members.

Brent’s upside should remain capped as long as global trade tensions keep feeding demand-side fears.

Oil benchmarks could also sink to fresh 4-year lows below $60/bbl if OPEC+ proceeds with yet another bumper-sized production hike in June.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.