Introducing the new

Alpari App

Your gateway to trading global markets.

Anywhere. Anytime.

100s of markets including Forex, Commodities, Indices, Cryptos and Stocks.

25 years' trading experience with 1m + clients worldwide

Fully segregated funds, with deposits secured at top-tier banks

Low trading costs, spreads from zero, and a generous rewards program

Your next profitable opportunity is out there.

Trade it with a global leader.

Alpari opens access to hundreds of markets, full of endless trading opportunities, and the potential of financial gain.

Trade Forex, Metals, Commodities, Indices, Crypto, and Stocks, all with the confidence you’re joining a trusted broker, with over 25 years of global market experience, and more than 1 million clients worldwide.

Open Account

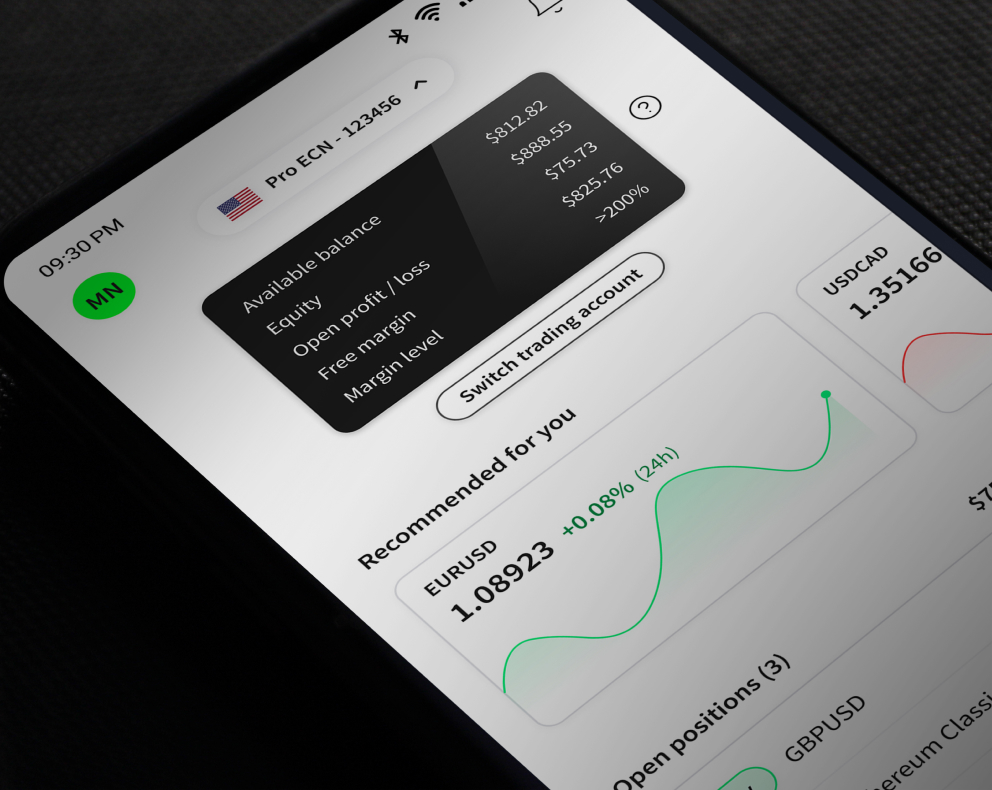

The Alpari App for trading wherever you are

Discover a seamless mobile trading experience.

Use the all-new Alpari App to tap into effortless trading where you can monitor, open, modify, and close trading positions, all in the palm of your hand. Anytime. Anywhere.

Never miss an opportunity with trading inspiration sent directly to your mobile, packed with personalised ideas and insights to action your next trade with one click.

Plus, you’ll earn Alpari Rewards points when you trade, and you can redeem cash rewards any time you like.

Explore the App

Earn as you trade with Alpari Rewards

Make trading even more rewarding with the Alpari Rewards loyalty programme.

Earn Tier and Rewards points on all qualifying trades. When you trade more, you’ll earn more, and ramp up the Tiers to unlock exclusive perks and discounts. Reach VIP-Master status and enjoy the ultimate benefits.

Redeem your points for funds in your trading account or withdraw as cash, any time you choose.

Start earningTake advantage of both rising and falling prices with Stocks CFDs from a leading global broker.

More